The International Group’s renewal rates for 2021. In a year of unparalleled disruption as a result of COVID-19 the International Group’s pooling arrangements and the General Excess of Loss and Collective Overspill Programme (GXL programme) provide shipowners with a measure of stability and comfort as they plan and budget for 2021.

Having secured a two year placement on the layers 1-3 of the GXL programme in 2020, the main focus this year has been on the Group’s Collective Overspill layer which provides cover for claims of US$1 billion excess of US$2.1 billion. Against a hardening market the Group has secured terms only slightly above expiring rates for shipowners. Importantly, the two year placement means that shipowners will not face any restrictions in cover for Covid-19 related claims.

Structurally, the GXL programme remains unchanged, with the emphasis having been on continuity and respecting the long term relationships that the Group has built up with many of the world’s leading reinsurers.

As part of its annual analysis to ensure the fairness of cost allocation between different vessel types, the Reinsurance Subcommittee (RISC) looked at current vessel categories. Having given due consideration, the RISC noted that Fully Cellular Container Ships (FCCs) now represent approximately 20% of the tonnage entered with Group Clubs and they have experienced a significant number of large claims in recent years.

The conclusions of the RISC are that:

- there should now be a fifth category splitting FCCs away from other Dry vessels; and

- that there should be an adjustment to reflect the improved record on persistent oil tankers.

Statement from the Chairman of the International Group’s Reinsurance subcommittee – Mike Hall:

“The Group’s decision to renew the majority of its programme last year for two years has provided our Members with the benefits of price stability and continuity of cover at a time when the reinsurance market is in a state of flux. We are grateful to our reinsurers for their continued support.

The introduction of a fifth category of vessel type and modest rate changes applied as a consequence, allow the rate charged to each type of vessel to continue to fairly reflect the loss experience that they have brought to the Group’s reinsurance arrangements.”

Renewal Overview

The main GXL programme (layers 1-3, US$2 billion excess of US$100 million) was fixed for two years in February 2020 and was not therefore subject to renewal in 2021.

The main focus was on the Group’s expiring Collective Overspill programme (US$1 billion excess of US$2.1 billion).

The Group’s reinsurance captive Hydra continues to support the Group through its risk retention at the primary part of the Group’s reinsurance structure. The Group’s strategy of placing a share of the reinsurance programme on a stand-alone basis through the use of private placements has continued to give shipowners greater stability in a year when market sentiment has been volatile as a result of the impact of the COVID-19 epidemic.

Together, these factors enabled the Group to achieve another satisfactory GXL programme renewal result, with rates for shipowners increasing by an average of 1.4% year-on-year.

Individual Club retention and GXL programme attachment

Individual Club retention remains unchanged for the 2021/22 policy year at US$10 million, as does the structure of the Pool and the attachment point for the GXL programme.

Reinsurance structure

Given the two year placement agreed for the main GXL programme (layers 1-3 for claims US$2 billion excess of US$100 million) in February 2020, the Group’s Reinsurance subcommittee decided not to make structural changes this year.

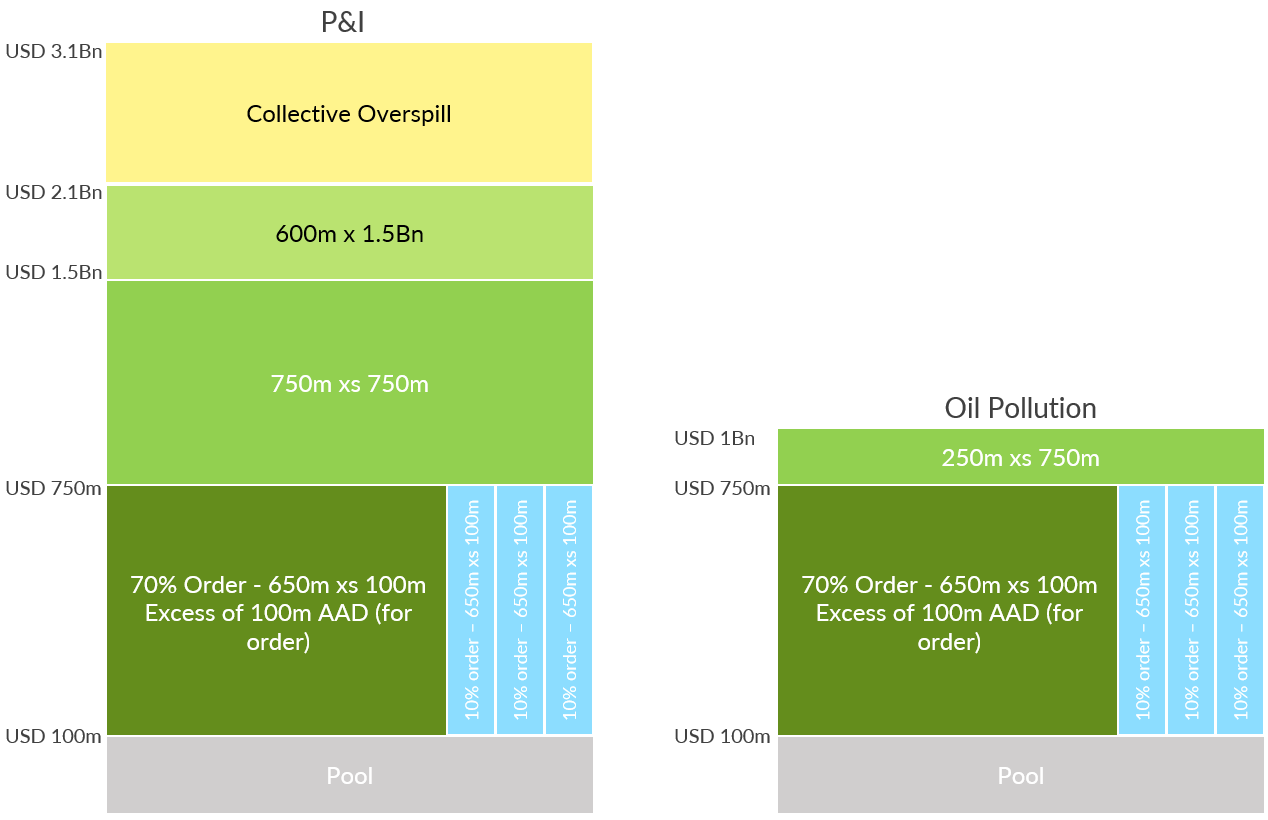

The three 10% private placements for the 2020/21 policy year each have at least one more year to run, with the 70% balance of layer 1 placed in the reinsurance markets.

Otherwise the US$100 million AAD (retained by the Group’s captive Hydra), within the 70% market share of layer 1 of the programme remains. The second layer covers US$750 million excess of US$750 million and the third layer US$600 million excess of US$1.5 billion. Both are 100% placed in the markets.

There is no change to the Collective Overspill layer, which provides US$1 billion of cover in excess of US$2.1 billion.

Hydra participation

Hydra continues to retain 100% of the Pool layer US$30 million – 50 million and 92.5% of the Pool layer US$50 million – US$100 million. Hydra also continues to retain a US$100 million AAD in the 70% market share of layer 1 of the GXL programme.

MLC cover

The MLC market reinsurance cover is being renewed for 2021 at competitive market terms, with the premium included in the overall reinsurance rates charged to shipowners.

War cover

The excess War P&I cover will be renewed for 2021 for a period of 12 months. Again, this will be included in the total rates charged to shipowners.

2021/22 GXL programme structure

The diagram below illustrates the layer and participation structure of the GXL programme for 2021/22

Reinsurance cost allocation 2021/22

As part of its annual analysis and in addition to reviewing premiums, the Reinsurance Subcommittee (RISC) has, as referred to above, been looking at vessel categories.

The conclusions of the RISC are that:

- there should now be a fifth category splitting FCCs away from other Dry vessels; and

- that there should be an adjustment to reflect the improved record on persistent oil tankers.

The 2021/22 rates are set out below:

| Tonnage category | 2021 rate per gt - in US cents | % change in rate per GT |

| Persistant Oil tankers | 56.25 | -2.1% |

| Clean Tankers | 26.19 | +1.4% |

| Dry | 40.28 | +1.4% |

| FCC | 42.49 | +7.0% |

| Passenger | 326.24 | +1.4% |

| Chartered tankers | 21.88 | +1.4% |

| Chartered dries | 10.68 | +1.4% |

This is a satisfactory reinsurance renewal for the International Group and its Members.

Mike Hall – Chairman of the International Group Reinsurance Subcommittee

Follow the below link for the original article published by the International Group of P&I Clubs.